Weekly Market Snap:

Weekly Market Movement:

In the past week, major stock indices faced persistent decline, despite an initial boost from lower-than-expected US inflation. However, market sentiment turned as the Reserve Bank of India (RBI) introduced an unexpected measure. The RBI's announcement of a 10% incremental cash reserve ratio (ICRR) for banks from August 12 aimed to manage liquidity.

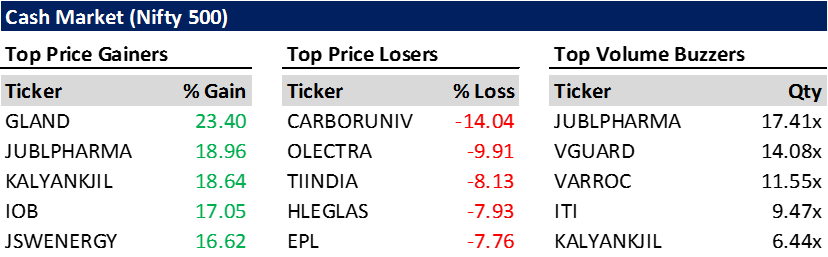

The Nifty index settled below 19,450, with three out of five trading sessions ending in losses. The S&P BSE Sensex dropped 398.60 points (0.61%), closing at 65,322.65, and the Nifty 50 index fell 88.70 points (0.45%) to 19,428.30. Despite this, the BSE Mid-Cap index rose 0.88% to 30,429.56, and the BSE Small-Cap index gained 0.63%, closing at 35,290.61.

Economically, RBI data showed a $3.2 billion decrease in foreign exchange reserves, totaling $603.9 billion by July 28, marking two consecutive weeks of decline. Agriculture ministry data highlighted Kharif crop coverage expanding by 0.41%, covering 91 million hectares.

In the effort to manage inflation, India's Food Secretary, Sanjeev Chopra, hinted at adjusting import tax on wheat. The RBI's monetary policy committee maintained the repo rate at 6.5%, emphasizing gradual alignment of inflation and economic growth.

Governor Shaktikanta Das projected India's GDP growth at 6.5% for 2023-24, distributed across quarters. Lastly, the temporary 10% I-CRR, introduced by the RBI, aimed to manage surplus liquidity, addressing factors like the reintroduction of Rs 2000 notes.