Weekly Market Snap:

Weekly Market Movement:

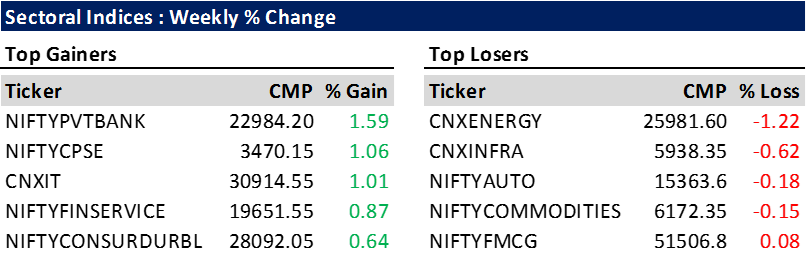

Indian equity benchmarks wrapped up the week with marginal declines, marking the fifth consecutive week of losses. However, the BSE Midcap and BSE Small-cap indices saw notable increases during this period. The Nifty index concluded the week below the 19,300 mark. Throughout the week, the benchmark indices recorded gains in three out of five trading sessions.

In the trading week concluding on August 25, 2023, the S&P BSE Sensex experienced a dip of 0.10%, shedding 62.15 points to reach a closing value of 64,886.51. Similarly, the Nifty 50 index witnessed a decrease of 0.23%, ending the week at 19,265.80. On the other hand, the BSE Mid-Cap index displayed a gain of 1.5%, settling at 30,717.91, while the BSE Small-Cap index surged by 2.19% to conclude at 36,055.96.

Economic Update:

In July, crude oil imports in India experienced a 1.2% month-on-month decline, reaching 19.32 million metric tons. This reduction aligned with lower consumption attributed to monsoon rains and decreased shipments from Russia and Saudi Arabia.

Highlighting the economic outlook, the finance ministry indicated that persistent global and regional uncertainties along with domestic disruptions could maintain inflationary pressures at an elevated level in India for the upcoming months.

Union Ministry's Jitendra Singh shared that India is well on its way to achieving a $150 billion bio-economy by 2025, surpassing the previous year's figure of over $100 billion in 2022.

RBI Governor Shaktikanta Das noted that vegetable prices within India are already demonstrating a decline, signaling a likely easing of inflation in this category starting from September, as he delivered a speech.

Focusing on agricultural targets, the government set a procurement goal of 521.27 lakh tonnes of rice from the ongoing kharif season. This follows the acquisition of 496 lakh tonnes of rice from last year's kharif harvest.