Weekly Market Snap:

Weekly Market Movement:

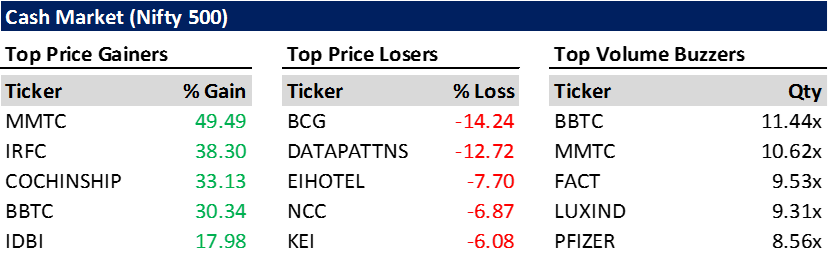

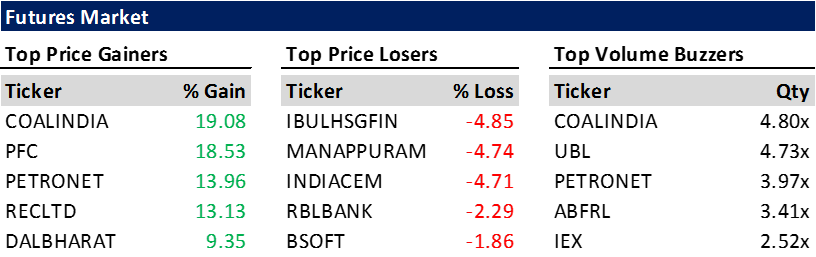

Indian equity markets had a strong second consecutive week, maintaining their positive trend. The broader market continued to outperform for the third consecutive week, and the Nifty index settled comfortably above 19,800. Benchmark indices recorded gains in all five trading sessions of the week.

For the week ending September 8, 2023, the S&P BSE Sensex surged by an impressive 1,211.75 points (1.85%) to close at 66,598.91. Similarly, the Nifty 50 index showed robust growth, advancing by 384.65 points (1.98%) to close at 19,819.95. The BSE Mid-Cap index demonstrated remarkable strength, surging by 3.93% to close at 32,672, while the BSE Small-Cap index gained 2.26%, concluding the week at 38,266.53.

Economic Update:

The Reserve Bank of India (RBI) made a significant announcement regarding the incremental cash reserve ratio (I-CRR), outlining a phased discontinuation plan. This plan involved releasing 25% of the I-CRR on September 9, 2023, followed by another 25% on September 23, 2023, and the remaining 50% on October 7, 2023. The RBI aimed to ensure a smooth functioning of money markets and prevent potential shocks to the financial system.

India's Goods and Services Tax (GST) collections for August exhibited robust growth, increasing by 10.8% year-on-year to reach Rs 1.59 lakh crore. While this represented a 3.7% decline compared to the previous month, it marked the sixth consecutive month where GST collections exceeded the Rs 1.5-lakh-crore mark.

Fuel consumption in India, a proxy for oil demand, rose by 6.5% year-on-year in August 2023, reaching approximately 18.57 million tons, according to data from the Petroleum Planning and Analysis Cell (PPAC). This marked an increase from the 18.11 million tons recorded in July.

India's external debt, relative to GDP, decreased, dropping to 18.9% by the end of March 2023 from 20% in March 2022, according to the Ministry of Finance's annual status report. In absolute terms, external debt increased by 0.9% to $624.7 billion, up from $619.1 billion in March 2022.