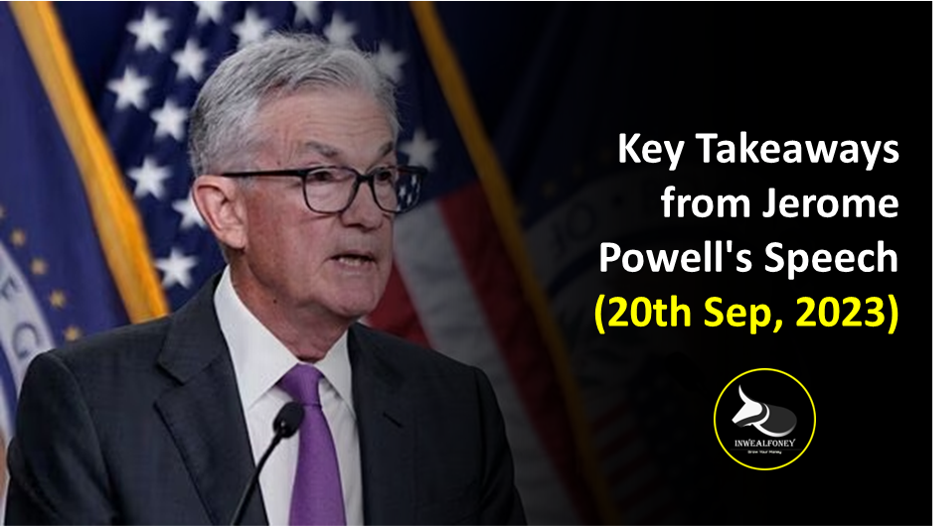

The FOMC (Federal Open Market Committee) maintained policy rates at 5.25-5.50%, as was widely expected. The statement maintained a hawkish tone and discussed conditions that would warrant further policy tightening.

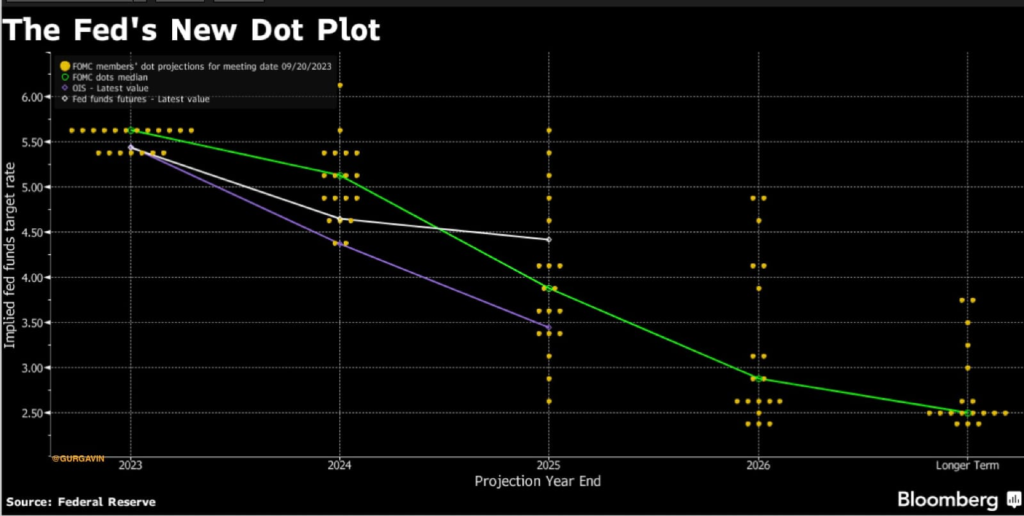

The "dot plot" indicated a median expectation for one more 25 basis points (bps) rate hike in 2023. A hawkish surprise came for 2024, with both median rate expectations for 2024 and 2025 rising by a full 50 bps, reducing the implied rate cuts for 2024 to 50 bps. During the press conference, Powell emphasized the challenges of forecasting and the mixed track record of forecasters.

Inflation Concerns:

- Acknowledges the challenges of high inflation.

- Reiterates commitment to achieving a 2 percent inflation goal.

- States that without price stability, the economy doesn't benefit anyone.

Economic Overview:

- Economic activity has been expanding steadily.

- Real GDP growth exceeded expectations.

- Consumer spending is robust.

- Housing sector activity increased, but remains below previous year's levels due to higher mortgage rates.

- Business fixed investment affected by higher interest rates.

- Real GDP growth projections: 2.1% this year, cooling to 1.5% next year.

Labor Market Insights:

- Labor market remains tight.

- Average payroll job gains of 150 thousand jobs per month in the past three months.

- Unemployment rate at 3.8%.

- Labor force participation rate has increased, especially for ages 25 to 54.

- Signs of easing in nominal wage growth and decline in job vacancies.

- Median unemployment rate forecasts for both 4Q24 and 4Q25 were revised downward to 4.1%.

Inflation Details:

- Inflation remains above the 2 percent goal.

- Total PCE prices rose 3.4% over the past 12 months.

- Core PCE prices (excluding food and energy) rose 3.9%.

- Inflation expectations appear anchored.

Monetary Policy Stance:

- Current policy is seen as restrictive.

- Economy faces challenges from tighter credit conditions.

- Target range for federal funds rate remains at 5.25% to 5.5%.

- Commitment to restrictive policy to achieve 2% inflation goal.

Federal Funds Rate Projections:

- Median projection: 5.6% end of this year, 5.1% end of 2024, and 3.9% end of 2025.

- Projections are individual assessments and not a Committee decision.

Future Outlook:

- Prepared to raise rates further if needed.

- Policy will remain restrictive until inflation is sustainably moving towards the goal.

- Commitment to achieving 2% inflation goal and anchoring long-term inflation expectations.

- Achieving price stability is essential for long-term goals of maximum employment and stable prices.