Weekly Market Snap:

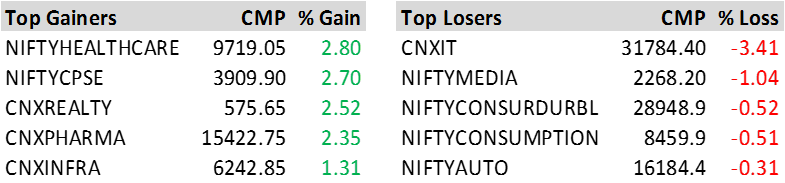

Sectoral Indices: Weekly % Change

Cash Market (Nifty 500):

Futures Market:

Weekly Market Movement:

The Indian stock market witnessed a downward trend for the second consecutive week, as concerns about rising oil prices and anticipation of increased US interest rates led to foreign institutional investor (FII) selling. However, the broader market performed better than the major indices, with the BSE Mid-Cap and Small-Cap indices gaining over 1% each.

For the week ending September 29, 2023, the S&P BSE Sensex decreased by 180.74 points or 0.27%, settling at 65,828.41. Similarly, the Nifty 50 index lost 35.95 points or 0.18%, closing at 19,638.30.

The week witnessed a mixed market performance, with the market ending nearly flat on Friday, breaking a four-day losing streak. The S&P BSE Sensex increased by 14.54 points (0.02%) to reach 66,023.69, while the Nifty 50 index added 0.30 points, closing at 19,674.55.

Economic Update:

On the economic front, the Indian Meteorological Department (IMD) suggested that conditions are becoming favorable for the withdrawal of the southwest monsoon from the country, expected around September 25. The Reserve Bank of India (RBI) introduced revised guidelines for banks, requiring them to create a board-approved investment policy and classify investments into three categories. Additionally, the government announced the sale of 18.09 lakh tonnes of wheat from the central pool to bulk users in 13 e-auctions under the open market sale scheme (OMSS) to help stabilize wheat and wheat flour prices.

Overall, the week was marked by profit booking and concerns about rising oil prices, alongside various economic developments impacting the Indian stock market.