Weekly Market Snap:

Weekly Market Movement:

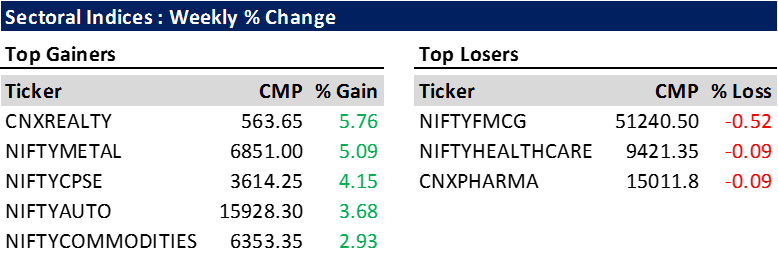

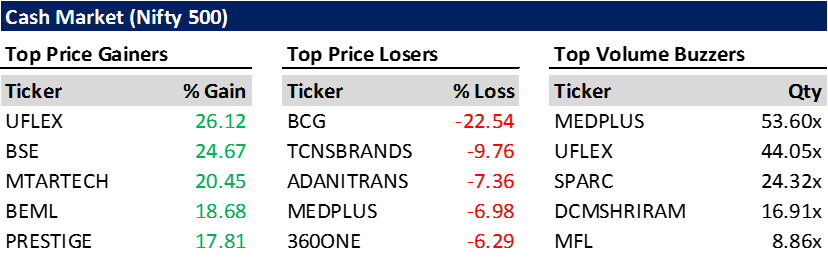

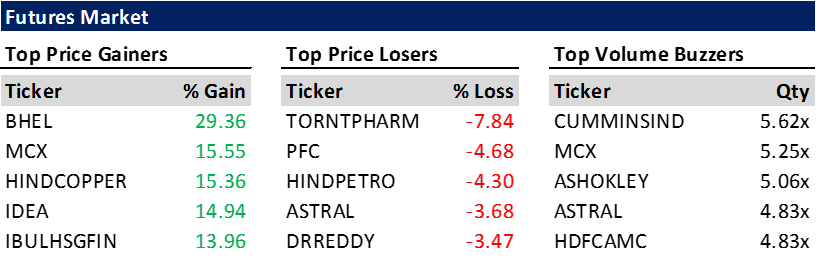

In the week ending September 1, 2023, Indian equity markets witnessed a significant turnaround, ending a five-week losing streak. The Nifty index closed above 19,400, and benchmark indices saw gains in four out of five trading sessions. The S&P BSE Sensex surged 0.77%, gaining 500.65 points to settle at 65,387.16, while the Nifty 50 index added 0.88%, closing at 19,435.30.

Additionally, the BSE Mid-Cap index advanced 2.34%, ending at 31,435.62, and the BSE Small-Cap index gained 3.78%, closing at 37,420.53. However, concerns lingered due to a monsoon deficit and foreign institutional investors' continuous selling, limiting overall market gains.

Despite the positive momentum driven by higher-than-expected domestic manufacturing PMI and positive GDP growth data, challenges such as the monsoon deficit and foreign institutional investor divestment tempered market enthusiasm during the week.

Economic Update:

India's foreign exchange reserves dropped to $594.89 billion, a two-month low, with a $7.273 billion decline, marking the steepest weekly fall in over six months by August 18. Gold reserves were down by $515 million to $43.824 billion, and Special Drawing Rights (SDRs) decreased by $119 million to $18.205 billion. The reserve position with the IMF also fell by $25 million to $5.072 billion in the same week.

A sub-committee under RBI Governor's leadership in the Financial Stability and Development Council pledged vigilance due to global uncertainties. The All-India Rice Exporters' Association (AIREA) expressed concerns that a minimum export price (MEP) of $1,200 per tonne might hinder rice exports.

Amitabh Kant, India's G20 Sherpa, stressed adopting new agricultural technologies and climate change adaptation in agriculture. Meanwhile, the government reduced the price of Liquefied Petroleum Gas (LPG) cylinders by Rs 200 per cylinder, an 18% cut for a 14.2 kg cylinder. However, Commerce and Industry Minister Piyush Goyal noted challenges, including geopolitical uncertainties, inflation, and slowing growth in various sectors.

Despite a 9% monsoon rainfall deficit, the S&P Global India Manufacturing Purchasing Managers' Index (PMI) rose to 58.6 in August, indicating a robust sectoral improvement. India's GDP grew by 7.8% in the April-June quarter of fiscal year 2023-2024, compared to 6.1% in the previous quarter, and the core sector saw a growth rate of 8% in July, slightly down from 8.3% in June.