Weekly Market Snap:

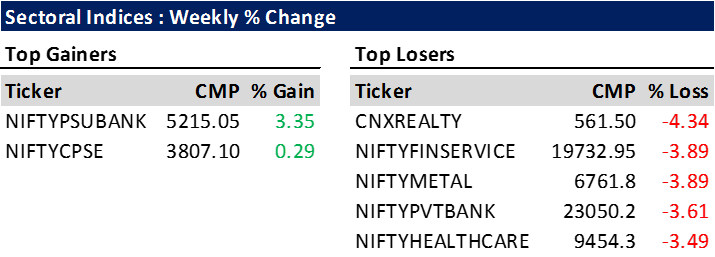

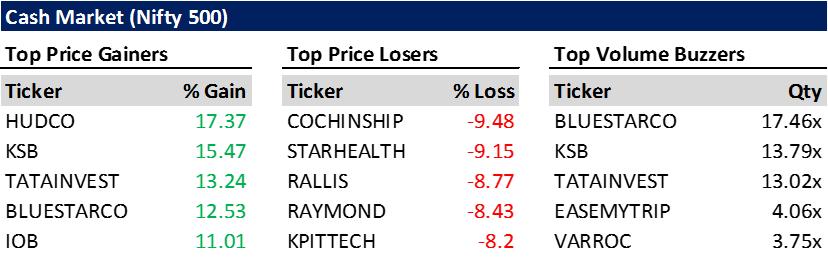

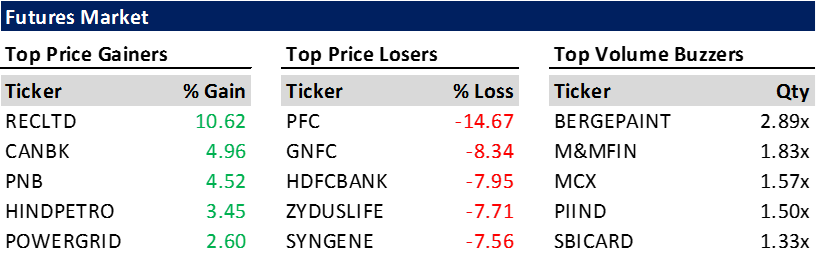

Weekly Market Movement:

The Indian stock market witnessed a significant bout of profit booking during the week ending September 22, 2023, marking a sharp contrast to the continuous gains witnessed in the previous three weeks. The Sensex concluded just above the 66,000 level, while the Nifty settled slightly above 19,650. The broader market, represented by the BSE Mid-Cap and Small-Cap indices, faced persistent selling pressure for the second consecutive week.

The week saw a sell-off in many sectors, including IT, metals, and banks. IT stocks were under pressure due to concerns about a global economic slowdown. Metal stocks were hit by falling commodity prices. Bank stocks saw profit-booking after a recent rally.

Economic indicators: Mixed bag

On the economic front, India posted a merchandise trade deficit of $24.2 billion in August 2023, the largest gap in ten months. Exports contracted by 6.9% year-on-year (YoY) to $34.5 billion, while imports also declined by 5.2% YoY to $58.6 billion.

The net Foreign Direct Investment (FDI) in India declined from $17.3 billion in April-July 2022 to $5.7 billion in April-July 2023.

Amid weakening global prospects, the Indian economy demonstrated resilience driven by robust private consumption, fixed investment, and substantial public sector capital expenditure.

However, the Asian Development Bank lowered its annual growth forecast for several Asian countries, including India. The ADB's revised growth projection for India in 2023 is 6.3%, slightly down from the previous projection of 6.4%.

RBI Measures

The RBI reported a significant decrease in Indian households' net savings in FY23 compared to FY22, with net savings falling to just 5.1% of GDP in FY23 from 7.2% in FY22.

To enhance data quality in credit reporting, the RBI directed credit information companies (CICs) to establish a common data quality index (DQI) for commercial and microfinance segments. This initiative aims to assess the quality of data submissions by credit institutions to CICs, ensuring more accurate and reliable credit information.

Overall Outlook

The Indian stock market's performance in the coming weeks will depend on a number of factors, including global economic trends, domestic economic growth, and corporate earnings. Investors will also be closely monitoring the RBI's monetary policy decisions.

On the economic front, the key watch-outs will be the upcoming GDP growth data and the inflation numbers. The RBI is expected to continue its hawkish stance in order to control inflation.

Overall, the outlook for the Indian stock market remains positive in the medium to long term. However, investors should be prepared for some volatility in the short term.