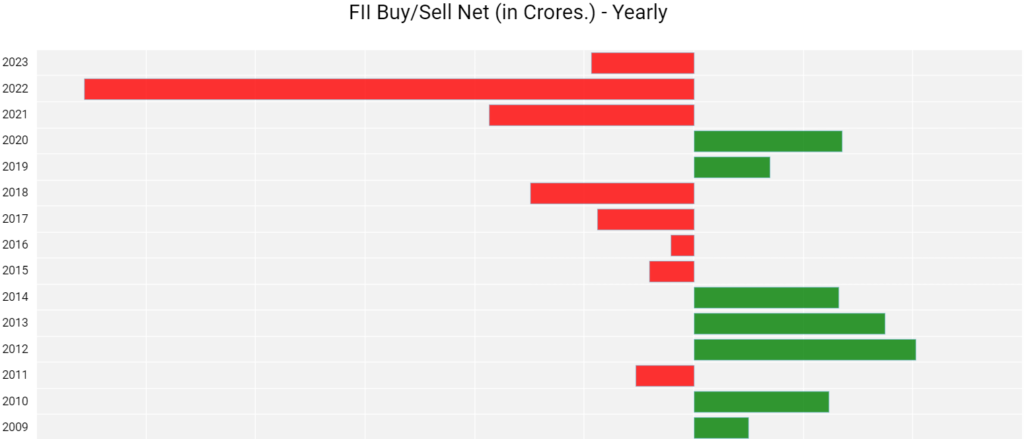

Indian equities have climbed to record highs, but a crucial piece of the puzzle has been missing: Foreign Institutional Investors (FIIs). After two years of net outflows, FIIs are now exhibiting renewed interest, driven by a confluence of positive macroeconomic factors and India's relative attractiveness compared to other emerging markets.

Growth & Stability: A Winning Combination

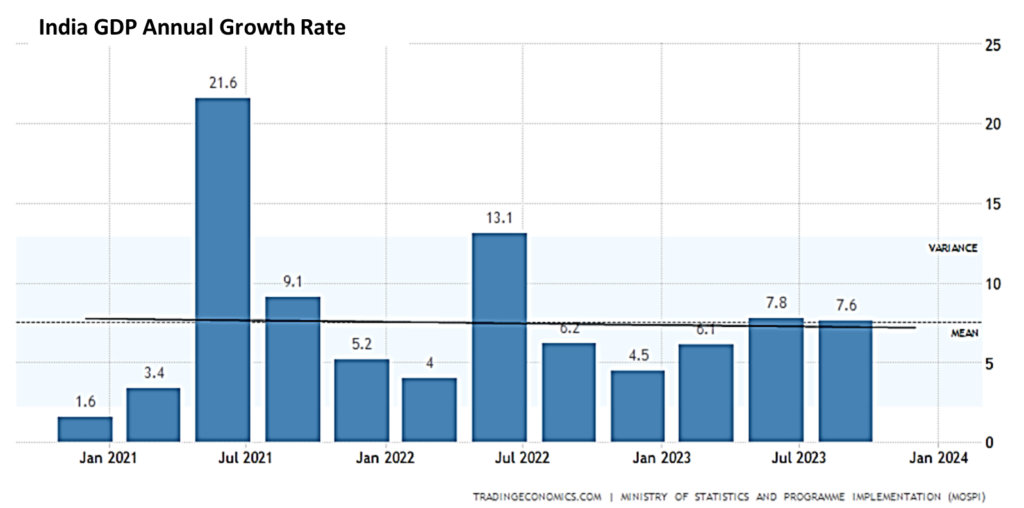

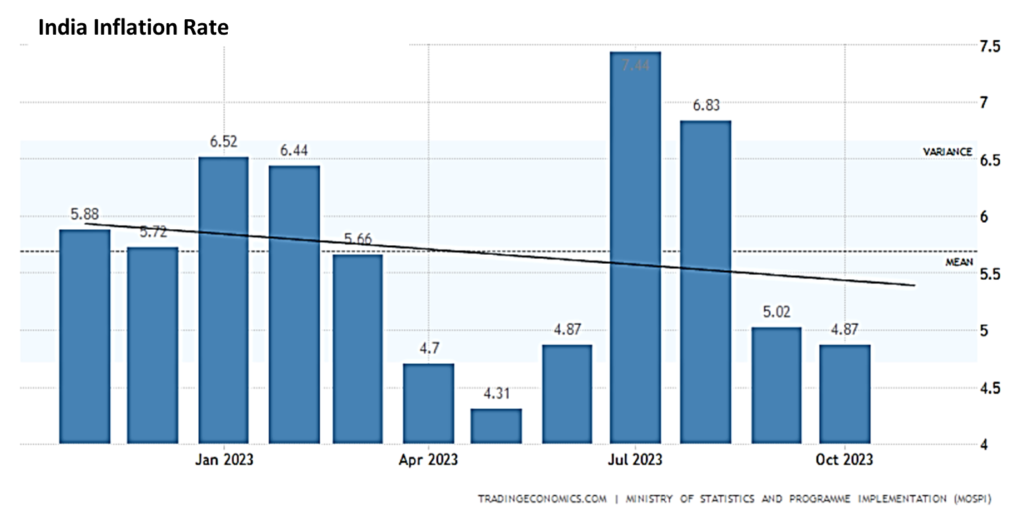

India's robust GDP growth (projected at 6.3% for FY24) coupled with controlled inflation paves the way for potential rate cuts, a siren song for yield-hungry FIIs.

Lower rates in India become even more enticing compared to the inflationary struggles of developed markets.

Furthermore, India's general elections 2024, will answer the most important questions related to political stability, a critical factor for risk-averse FIIs. This predictability and long-term vision instill confidence, making India a safe harbor in a sea of global uncertainties.

India: The Shining Star Among EMs

Beyond these internal strengths, India's relative positioning compared to other emerging markets adds further fuel to the FII fire:

Inflationary Champion:

While many EMs grapple with double-digit inflation, India's sub-7% success story makes it a beacon of stability for FIIs seeking to preserve returns.

Macroeconomic Powerhouse: Record-high forex reserves and booming FDI paint a picture of economic resilience that attracts FIIs. This strength is further amplified by a young and growing domestic market, a future consumption engine for global brands.

The FII Impact: A Rising Tide Lifts All Boats

The return of FIIs is likely to trigger a cascade of positive effects:

- Increased Liquidity: Fresh FII inflows will bolster market depth and liquidity, potentially leading to higher valuations and broader market participation.

- Sectoral Spotlight: Sectors like IT, consumer staples, and infrastructure, traditionally favored by FIIs, could see a significant upswing. This presents both opportunities and challenges for domestic investors seeking to align their portfolios.

A Word of Caution: Embrace the Dance, Not the Delusion

Market dynamics are ever-evolving, and geopolitical risks can never be entirely discounted. However, the return of FIIs signifies a vote of confidence in India's growth story and its resilience amidst global headwinds. As we navigate this exciting phase, it's crucial to approach with informed optimism, embracing the potential tailwinds while remaining cognizant of inherent risks.

Join our WhatsApp Group for Trading/Investment ideas & Market Updates 👇