About the Company:

- SBFC Finance Limited is a non-banking finance company established in 2008.

- It does not take deposits but provides important financial services.

- The company mainly serves entrepreneurs, small business owners, self-employed individuals, and working-class people.

- SBFC offers two types of services: Secured MSME Loans and Loans against Gold.

- It aims to help those who are underserved by traditional banks.

- The company considers various factors before providing loans to ensure the borrower's success.

- SBFC has a strong presence across India with branches in 105 cities across 16 states and two union territories.

Financials and Valuation:

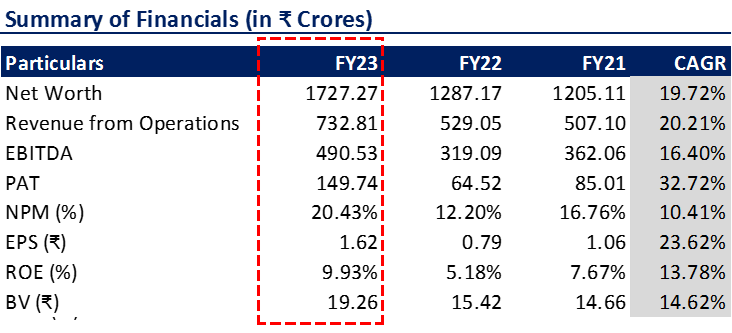

The following table shows the summary of financials for the latest three financial years along with CAGR return from FY21 to FY23.

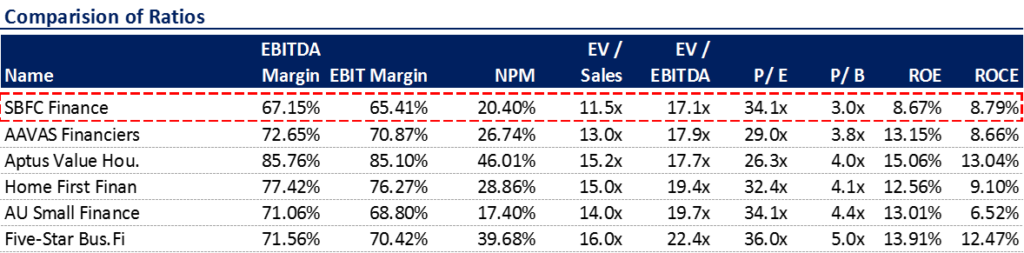

Next, we compare the key valuation ratios with the listed peers of SBFC Finance Limited.

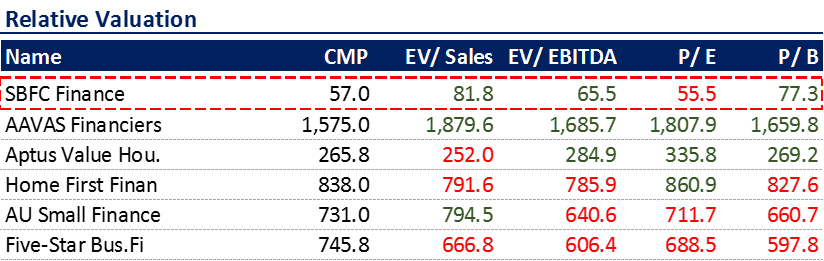

Based on the financials of FY23 and the upper price band of the IPO, we can calculate the relative valuation as mentioned in the below table:

Conclusion:

1) Apart from the Price to Earnings Ratio, the valuation of SBFC Finance Limited appears justified based on the other three criteria as mentioned in the above table.

2) As per the latest GMP, a listing gain in the range of 30% to 40% can be expected subject to the overall market conditions.

Note: For additional information & risk factors please refer to the Red Herring Prospectus

Disclaimer: We are not SEBI registered. All the views are personal and only for educational purposes. Do your due diligence before making any trading or investing decision. The data provided in this blog post is for illustrative purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making investment decisions.

Read the detailed ‘Disclaimer’ here.