About the Company:

Vishnu Prakash R Punglia Ltd. (VPRPL) is an ISO-certified company that handles engineering, procurement, and construction work. They create important things like roads, railways, water supply systems, and irrigation networks in various parts of India. They've worked for government bodies and private groups across nine states and one union territory.

VPRPL is recognized by different departments as a reliable contractor. They're authorized to work on big projects for organizations like the Jodhpur Development Authority, Public Health Engineering Department, Water Resources Department, Roads and Building Department, and more.

The company has its own teams for planning, buying materials, managing projects, and ensuring quality. They even have 499 vehicles and equipment for construction. They don't rely on other companies for crucial materials or services, which helps them control the entire project process.

VPRPL usually handles projects on its own, but sometimes partners with other construction companies for specific tasks. They've managed projects worth Rs. 3799.53 crore till July 15, 2023.

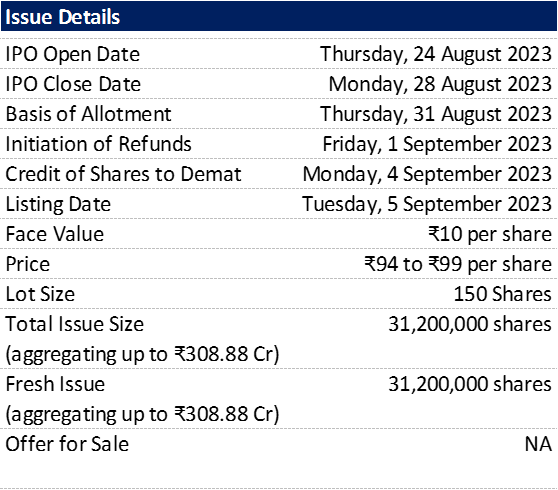

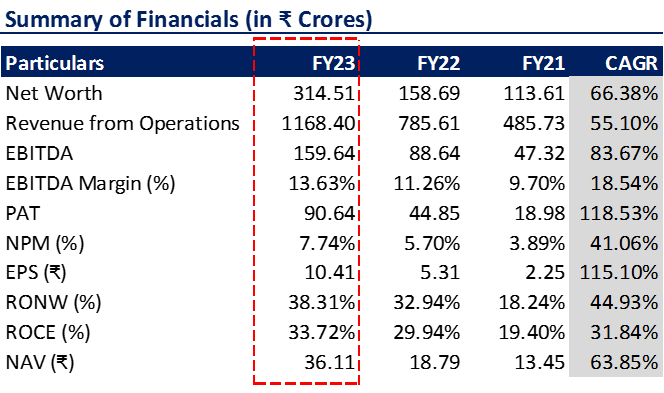

Financials and Valuation:

The table below presents a financial summary for the most recent three fiscal years, along with the Compound Annual Growth Rate (CAGR) return spanning from FY21 to FY23.

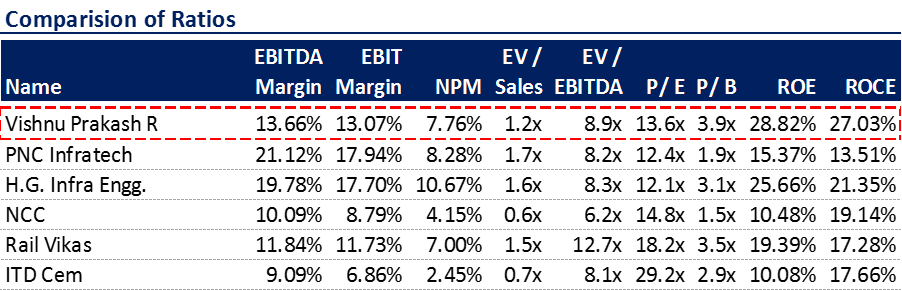

Comparision with Listed Peers:

Next, we compare the key valuation ratios with the listed peers of Vishnu Prakash R Punglia Limited.

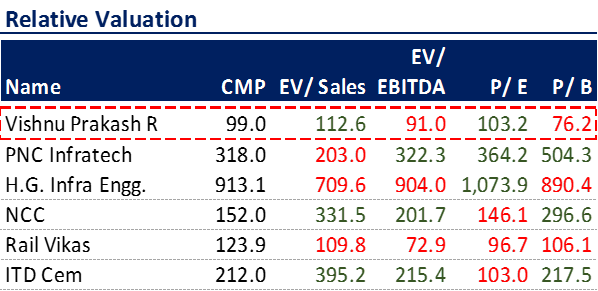

Relative Valuation:

Based on the financials of FY23 and the upper price band of the IPO, we can calculate the relative valuation as mentioned in the below table:

Conclusion:

1) If we compare the latest financials of VPRPL with the listed peers, the IPO is fully priced, and thus, the valuation seems justified.

2) Moreover, considering the latest GMP, it's reasonable to anticipate 38% to 43% listing gains, given the prevailing market conditions.

Note: For additional information & risk factors please refer to the Red Herring Prospectus

Disclaimer: We are not SEBI registered. All the views are personal and only for educational purposes. Do your due diligence before making any trading or investing decisions. The data provided in this blog post is for illustrative purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making investment decisions.

Read the detailed ‘Disclaimer’ here.