About the Company:

Jupiter Life Line Hospitals Limited, founded in 2007, is a renowned healthcare institution specializing in various medical fields. It provides advanced healthcare services in the Mumbai Metropolitan Area (MMR) and the western region of India.

Purpose of the IPO

The company aims to use the funds raised from the IPO for two main purposes:

- Paying off loans obtained from banks by the company and its subsidiary.

- Meeting general corporate needs and expenses.

Promoter Ownership

The current promoters hold 40.69% of the company's shares before the IPO

Company Overview

Jupiter Hospital, the first of its kind, is strategically located near the Eastern Express Highway in Thane, ensuring easy access for patients from Thane and nearby areas. The hospital expanded its reach to Pune in 2017 and later to Indore, Madhya Pradesh, in 2020, with Vishesh Jupiter Hospital. Altogether, these hospitals have over 1100 beds across three cities. They use a Greenfield strategy to provide comprehensive healthcare services.

The hospitals have specialized departments staffed by highly skilled doctors and healthcare professionals. They cover a wide range of medical specialties, including bariatric surgery, cardiac surgery, cardiology, dermatology, gastroenterology, nephrology, neurology, neurosurgery, gynecology, urology, and more.

Jupiter Hospital is known for its advanced offerings, such as computer-assisted neuro rehab centers and robotic knee replacement surgeries. Additionally, the hospital is currently constructing a multi-specialty healthcare facility in Dombivli, Maharashtra, with plans for more than 500 beds.

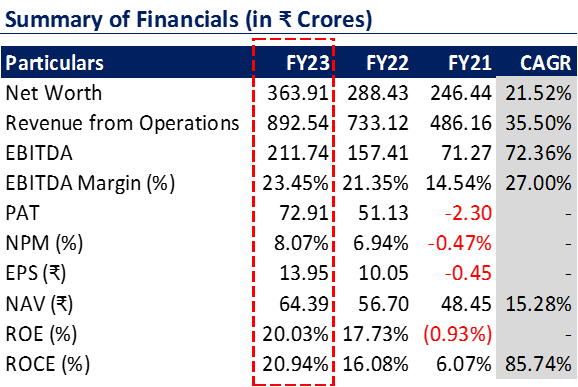

Financials and Valuation:

The table below presents a financial summary for the most recent three fiscal years, along with the Compound Annual Growth Rate (CAGR) return spanning from FY21 to FY23.

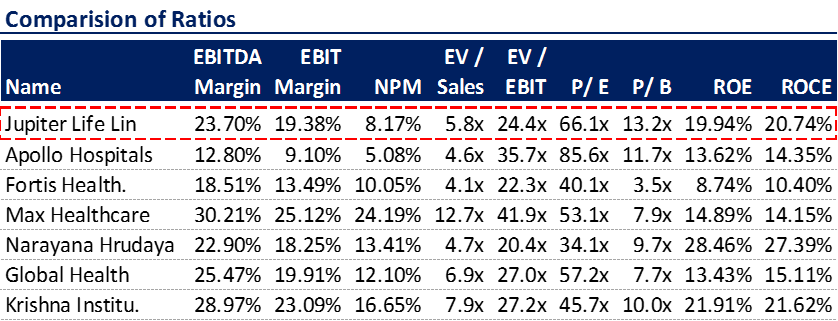

Comparison with Listed Peers:

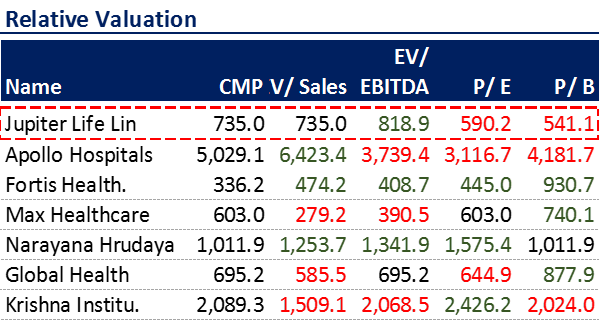

Next, we compare the key valuation ratios with the listed peers of Jupiter Life Line Hospitals Limited.

Relative Valuation:

Based on the financials of FY23 and the upper price band of the IPO, we can calculate the relative valuation as mentioned in the below table:

Conclusion:

1) If we compare the latest financials of the company with the listed peers, the IPO is fully priced, and thus, the valuation seems okay from the long-term perspective.

2) Moreover, considering the latest GMP, it's reasonable to anticipate 18% to 23% listing gains, given the prevailing market conditions.

Note: For additional information & risk factors please refer to the Red Herring Prospectus

Disclaimer: We are not SEBI registered. All the views are personal and only for educational purposes. Do your due diligence before making any trading or investing decisions. The data provided in this blog post is for illustrative purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making investment decisions.

Read the detailed ‘Disclaimer’ here.