About the Company:

TVS Supply Chain Solutions Limited offers supply chain management services to international organizations, government departments, and medium to large businesses.

Its services are divided into two segments: Integrated supply chain solutions (ISCS) and Network Solutions (NS). The ISCS segment covers various aspects such as sourcing, procurement, transportation, logistics, in-plant operations, aftermarket fulfillment, and consulting. The NS segment includes global forwarding solutions, warehousing, value-added services, and time-critical final mile solutions.

During the fiscal year 2022 and the nine months until December 31, 2022, TVS SCS assisted 10,531 and 8,115 customers worldwide, along with 1,044 and 733 customers in India, which also included prominent 'Fortune Global 500 2022' companies.

The company caters to industries like Automotive, Defence, FMCG, Rail, Utilities, E-commerce, and Healthcare. Notable clients include Hyundai Motor India, Johnson Controls-Hitachi, Ashok Leyland, and Daimler India Commercial Vehicles.

TVS Supply Chain Solutions achieved a total income of Rs. 92,999.36 million in Fiscal 2022.

Financials and Valuation:

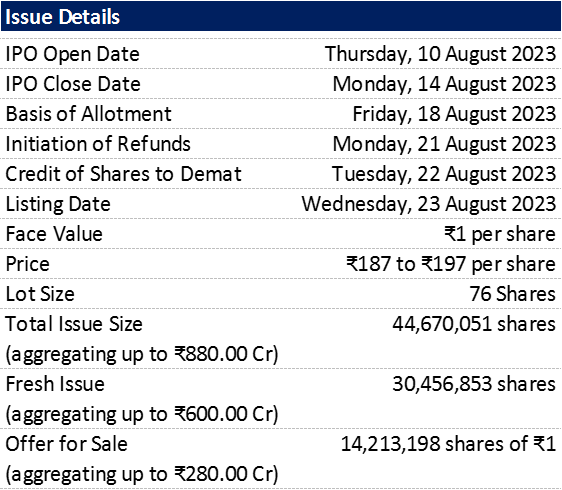

The table below presents a financial summary for the most recent three fiscal years, along with the Compound Annual Growth Rate (CAGR) return spanning from FY21 to FY23.

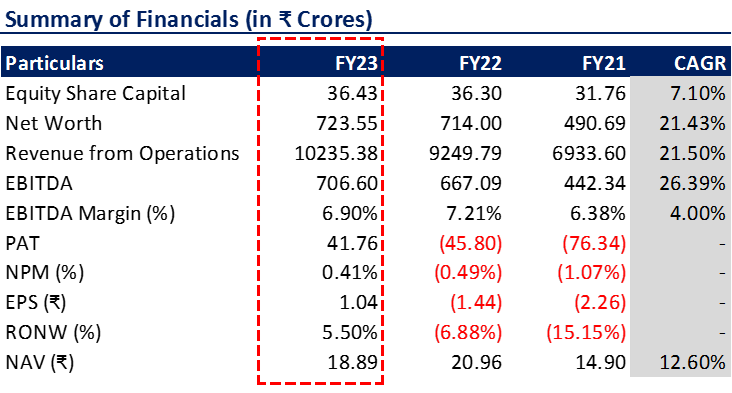

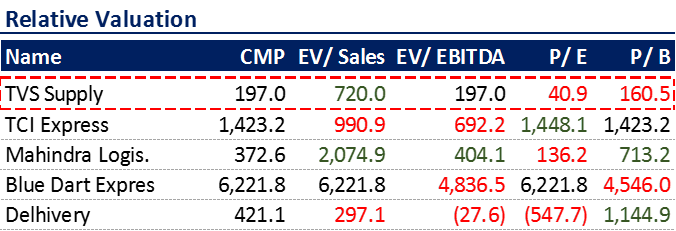

Next, we compare the key valuation ratios with the listed peers:

Finally, based on the financials of FY23 and the upper price band of the IPO, we can calculate the relative valuation as mentioned in the below table:

Conclusion:

1) When evaluating all the criteria collectively, it becomes apparent that this IPO is priced aggressively and appears to be overvalued in comparison to its listed peers.

2) Considering the latest GMP, it's reasonable to anticipate either minimal or no potential for listing gains, given the prevailing market conditions.

Note: For additional information & risk factors please refer to the Red Herring Prospectus

Disclaimer: We are not SEBI registered. All the views are personal and only for educational purposes. Do your due diligence before making any trading or investing decision. The data provided in this blog post is for illustrative purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making investment decisions.

Read the detailed ‘Disclaimer’ here.