About the Company:

Incorporated in 1993, Aeroflex Industries Limited specializes in crafting and distributing environmentally friendly metallic flexible flow solutions worldwide. Their unique products, such as bendable pipes and hoses, find applications across the globe, including in Europe and the USA. Impressively, they export to over 80 countries, with exports contributing significantly to their revenue.

These solutions play a crucial role in facilitating the controlled movement of substances like air, liquids, and solids across industries. By using stainless steel and even bronze, Aeroflex Industries crafts products that replace traditional rubber and polymer solutions, championing eco-friendliness due to their lower carbon emissions.

Their extensive product lineup includes hoses, connectors, and more, designed to withstand diverse environments, from extreme temperatures (ranging from -196°C to 982°C) to high pressures (up to 300 bars).

Notably, customers, particularly Original Equipment Manufacturers, rigorously assess product quality and manufacturing processes, adding an extra layer of quality assurance. In essence, Aeroflex Industries excels in producing adaptable metal products that ensure smooth substance flow while prioritizing environmental sustainability.

Financials and Valuation:

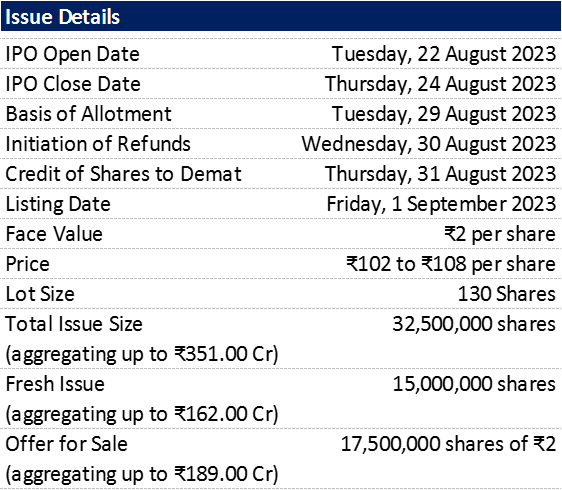

The table below presents a financial summary for the most recent three fiscal years, along with the Compound Annual Growth Rate (CAGR) return spanning from FY21 to FY23.

Taking into account the upper price band and FY23 earnings, the P/E ratio comes out to be approximately 40.9x, while the P/BV ratio stands at around 10.8x.

There aren't any listed companies in the same line of business, but AIA Engineering Limited specializes in producing high chrome grinding media and mill liners. Their P/E ratio is 31.6x, and their Price-to-Book Value is 5.9 times. Another listed company, SAT Industries, which is also the parent company of Aeroflex Industries, has a P/E ratio of 38.4x.

Conclusion:

1) As per the latest financials, the issue appears fully priced, and thus, the valuation seems justified.

2) Moreover, considering the latest GMP, it's reasonable to anticipate 38% to 43% listing gains, given the prevailing market conditions.

Note: For additional information & risk factors please refer to the Red Herring Prospectus

Disclaimer: We are not SEBI registered. All the views are personal and only for educational purposes. Do your due diligence before making any trading or investing decision. The data provided in this blog post is for illustrative purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making investment decisions.

Read the detailed ‘Disclaimer’ here.