About the Company

Founded in 1974 by Late Mr. Chaman Lal Setia, Chaman Lal Setia Exports Ltd transitioned from a Partnership Firm in 1983 to a Public Limited Company in 1994. Specializing in basmati rice milling and processing, the company earned recognition as a 'Star Export House,' exporting to over 80 countries across Europe, the Middle East, America, and Asia. Its manufacturing unit in Karnal boasts an automated rice processing facility with a 12 metric tonnes per hour capacity, while grading and sorting facilities are situated in Amritsar and Kandla.

The company's flagship brand, 'Maharani,' along with 'Mithas' and 'Begum,' dominates the basmati market. Notably, it also markets non-basmati rice under the brand 'Green World Aromatic Rice' and offers innovative products like 'Maharani Diabetics Rice' and 'Basmati Rice Plus.' With an extensive marketing network, the company sells a diverse range of basmati rice, including the Super A variety, under the globally recognized brand, Maharani.

Chaman Lal Setia Exports Ltd went public in 1995 to fund expansion and modernization, doubling its capacity to 4 TPM. In 2018, a new packing unit was inaugurated in Gandhidham, Gujarat. The company received listing approval on the National Stock Exchange in May 2021, marking its entry into the stock market.

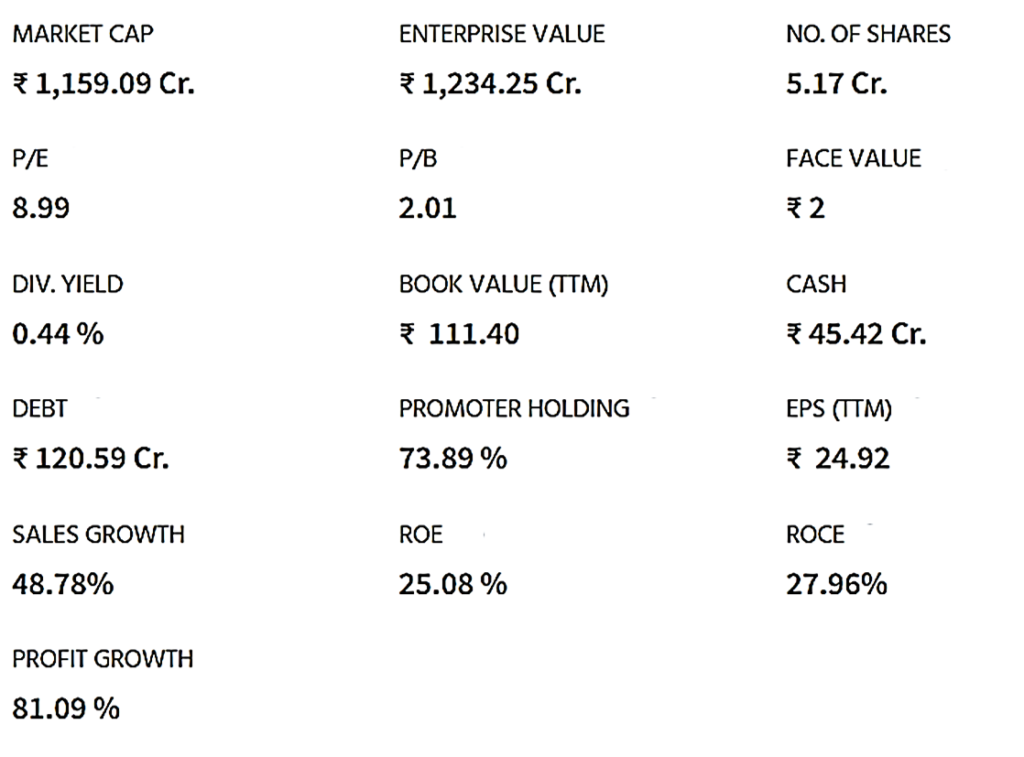

Company Essentials:

Key Ratios:

Technical Study:

CMP: 224

From the above weekly chart of CLSEL, we can observe, that the stock is in an uptrend making higher highs and higher lows along with rising volume.

Key Technical Indicators on Weekly Chart:

- RSI: 59 (Moderate Buy Zone)

- MACD line is below signal line, however, it is above 0.

- Price is trading above all the important exponential moving averages (21, 55, 100, 200 EMAs)

Key Driving Factors:

- The company has shown a good profit growth of 30.89% for the Past 3 years.

- The company has shown a good revenue growth of 20.26% for the Past 3 years.

- Company has been maintaining healthy ROE of 22.84% over the past 3 years.

- Company has been maintaining healthy ROCE of 25.59% over the past 3 years.

- Company has a healthy Interest coverage ratio of 22.59.

- Company’s PEG ratio is 0.11.

- Company has a healthy liquidity position with current ratio of 4.27.

- The company has a high promoter holding of 73.89%.

Future Outlook:

- CSEL's future appears promising, supported by:

- Strong brand recognition, particularly in the Middle East and African markets.

- Expanding domestic market for premium basmati rice.

- Focus on organic and specialty basmati varieties.

- Potential challenges include:

- Fluctuations in basmati rice prices due to weather and supply chain disruptions.

- Intense competition in the domestic and export markets.

You may add this to your watch list to understand further price action.

Disclaimer: We are not SEBI registered. All the views are personal and only for educational purposes. Do your due diligence before making any trading or investing decisions. The data provided in this blog post is for illustrative purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making investment decisions.

Read the detailed ‘Disclaimer’ here.

Join our WhatsApp Group for Trading/Investment ideas & Market Updates 👇